Gordon Wu's net worth refers to the total value of the assets owned by the Hong Kong billionaire, Gordon Wu Ying-sheung. It includes his stakes in various businesses, properties, and investments.

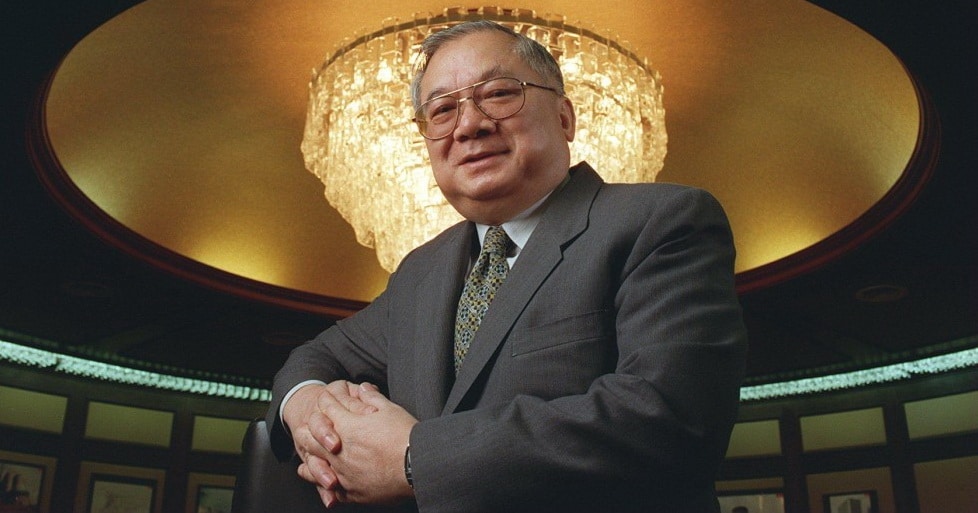

Gordon Wu is a prominent figure in the Hong Kong business community. He is the founder and chairman of Hopewell Holdings, a conglomerate with interests in property development, infrastructure, and telecommunications. Wu's net worth is estimated to be around $4.3 billion, making him one of the wealthiest people in Hong Kong.

Wu's wealth has been built through a combination of successful business ventures and savvy investments. He has a reputation for being a shrewd businessman and a keen investor. Wu's business acumen has helped him to build a vast fortune and become one of the most successful entrepreneurs in Hong Kong.

Read also:Unveiling The Mysteries Of June 3 Zodiac Sign A Comprehensive Guide

Gordon Wu's Net Worth

Gordon Wu's net worth, estimated at $4.3 billion, is a testament to his success as a businessman and investor. Here are ten key aspects that contribute to his vast wealth:

- Property development: Hopewell Holdings, founded by Wu, is one of Hong Kong's largest property developers.

- Infrastructure: Hopewell Holdings has significant investments in infrastructure projects, including roads, bridges, and power plants.

- Telecommunications: Wu has a stake in Hong Kong Telecommunications (HKT), one of the city's leading telecom operators.

- Investments: Wu has made numerous successful investments in stocks, bonds, and other financial instruments.

- Business acumen: Wu is known for his shrewd business sense and ability to identify profitable opportunities.

- Strategic partnerships: Wu has formed strategic partnerships with other businesses, including China Resources and Hutchison Whampoa.

- Government contracts: Hopewell Holdings has secured numerous government contracts for infrastructure projects.

- Property portfolio: Wu owns a substantial property portfolio in Hong Kong and other parts of Asia.

- Art collection: Wu is an avid art collector, and his collection includes works by renowned artists such as Pablo Picasso and Zhang Daqian.

- Philanthropy: Wu is a noted philanthropist, and he has donated millions of dollars to various charitable causes.

These key aspects highlight the diverse sources of Gordon Wu's wealth. His success as a businessman and investor has made him one of the wealthiest people in Hong Kong. Wu's wealth has allowed him to pursue his interests in art collecting and philanthropy, and he has made significant contributions to Hong Kong society.

| Name | Gordon Wu Ying-sheung |

|---|---|

| Birth Date | 1934 |

| Birth Place | Shanghai, China |

| Citizenship | Hong Kong |

| Occupation | Businessman, investor |

| Net Worth | $4.3 billion |

Property development

Property development is a major contributor to Gordon Wu's net worth. Hopewell Holdings, the property development arm of his business empire, has been instrumental in generating substantial wealth for Wu. The company has developed numerous residential, commercial, and industrial properties in Hong Kong and other parts of Asia. These properties generate rental income and capital gains, which have significantly increased Wu's wealth over the years.

One of the key factors behind Hopewell Holdings' success is its ability to secure prime development sites in Hong Kong, a city with a limited land supply. The company has also been able to capitalize on the strong demand for property in Hong Kong, driven by the city's growing population and economic prosperity. As a result, Hopewell Holdings has been able to generate high profits from its property development projects.

The success of Hopewell Holdings has not only contributed to Gordon Wu's net worth but has also made him one of the most influential figures in the Hong Kong property market. He is known for his visionary approach to property development and his ability to identify and capitalize on opportunities. Wu's success in property development serves as an example of how this sector can be a major driver of wealth creation in Hong Kong.

Infrastructure

Hopewell Holdings' significant investments in infrastructure projects, including roads, bridges, and power plants, have played a vital role in generating wealth for Gordon Wu. These projects provide essential services to communities and businesses, and they generate stable, long-term revenue streams. As a result, they have been a key driver of Hopewell Holdings' financial success and, consequently, Gordon Wu's net worth.

Read also:Jon Bon Jovi Daughter The Untold Story Of A Rock Stars Legacy

One of the key benefits of infrastructure investments is that they are often supported by long-term contracts with governments or other entities. This provides a reliable source of revenue for Hopewell Holdings, which can then be used to fund further growth and expansion. In addition, infrastructure projects can often generate economies of scale, which can further increase profitability.

Furthermore, infrastructure investments can have a positive impact on the overall economy. By providing essential services, such as transportation and energy, infrastructure projects can help to improve productivity and economic growth. This can lead to increased demand for Hopewell Holdings' services, further boosting the company's revenue and Gordon Wu's net worth.

The connection between Hopewell Holdings' infrastructure investments and Gordon Wu's net worth is a clear example of how infrastructure can be a major driver of wealth creation. By investing in essential services, Hopewell Holdings has been able to generate stable, long-term revenue streams, which have significantly increased Gordon Wu's net worth.

Telecommunications

Gordon Wu's stake in Hong Kong Telecommunications (HKT), one of the city's leading telecom operators, is a significant contributor to his net worth. HKT provides a wide range of telecommunications services, including mobile, broadband, and fixed-line services. The company has a large customer base in Hong Kong and is a major player in the telecommunications market.

- Revenue generation: HKT generates revenue from its various telecommunications services. These services are essential to businesses and consumers in Hong Kong, and HKT's strong market position allows it to charge competitive prices. The revenue generated by HKT contributes to Gordon Wu's net worth.

- Asset value: HKT's extensive network infrastructure, including mobile towers, fiber optic cables, and data centers, is a valuable asset. This infrastructure allows HKT to provide high-quality telecommunications services to its customers. The value of this infrastructure contributes to Gordon Wu's net worth.

- Growth potential: The telecommunications market in Hong Kong is expected to continue to grow in the coming years. This growth is driven by the increasing demand for mobile data and broadband services. HKT is well-positioned to capitalize on this growth, which could lead to further increases in its revenue and asset value, and consequently, Gordon Wu's net worth.

- Synergy with other businesses: HKT's telecommunications services can be bundled with other services offered by Hopewell Holdings, such as property development and infrastructure. This bundling can create additional value for customers and increase revenue for Hopewell Holdings, which can also benefit Gordon Wu's net worth.

Overall, Gordon Wu's stake in HKT is a valuable asset that contributes significantly to his net worth. The company's strong market position, revenue-generating capabilities, and growth potential make it a key driver of Gordon Wu's wealth.

Investments

Gordon Wu's investments in stocks, bonds, and other financial instruments have played a significant role in building his net worth. Wu is known for his astute investment sense and ability to identify undervalued assets. He has made numerous successful investments over the years, which have generated substantial returns and contributed significantly to his overall wealth.

One of the key reasons why Wu's investments have been so successful is his long-term investment horizon. He is willing to hold investments for many years, allowing them to compound and grow in value. This patient approach has paid off handsomely, as many of his investments have significantly increased in value over time.

Another reason for Wu's investment success is his diversification strategy. He invests in a wide range of asset classes, including stocks, bonds, real estate, and private equity. This diversification helps to reduce risk and improve the overall performance of his investment portfolio. By investing in a variety of asset classes, Wu is able to reduce his exposure to any one particular sector or market.

Wu's investment strategy has not only helped him to build his net worth but has also made him one of the most successful investors in Hong Kong. His ability to identify undervalued assets and hold them for the long term has been a key factor in his investment success.

The connection between Wu's investments and his net worth is clear. His successful investments have generated substantial returns, which have significantly increased his overall wealth. Wu's investment strategy is a valuable lesson for anyone who wants to build wealth through investing.

Business acumen

Gordon Wu's business acumen is widely recognized as a key factor in his remarkable net worth. His ability to identify and capitalize on profitable opportunities has been instrumental in building his wealth over the years.

One of the most notable examples of Wu's business acumen is his early investment in the property market. In the early 1970s, Wu recognized the potential for growth in Hong Kong's property sector. He invested heavily in residential and commercial properties, which later became highly valuable as Hong Kong's economy boomed. This investment strategy laid the foundation for Wu's vast wealth.

Wu's business acumen is not limited to property development. He has also made successful investments in infrastructure, telecommunications, and other industries. His ability to identify undervalued assets and growth opportunities has allowed him to generate substantial returns on his investments, further increasing his net worth.

Beyond his individual investments, Wu's business acumen has also been a driving force behind the success of Hopewell Holdings, the conglomerate he founded. Under Wu's leadership, Hopewell Holdings has become one of Hong Kong's largest and most successful companies. The company's diverse portfolio of businesses, including property development, infrastructure, and telecommunications, is a testament to Wu's ability to identify and capitalize on profitable opportunities.

The connection between Wu's business acumen and his net worth is clear. His shrewd business sense and ability to identify profitable opportunities have been the driving forces behind his wealth creation. Wu's success story is a valuable lesson for anyone who wants to build wealth through business and investing.

Strategic partnerships

Strategic partnerships have played a significant role in Gordon Wu's wealth creation and the growth of his net worth. By forming strategic partnerships with other businesses, Wu has been able to leverage their strengths and resources to expand his business empire and generate additional revenue streams.

One of the most notable examples of Wu's strategic partnerships is his collaboration with China Resources. In 1992, Hopewell Holdings and China Resources formed a joint venture to develop the Beijing Oriental Plaza, a large-scale commercial and residential complex in Beijing. This partnership allowed Hopewell Holdings to gain a foothold in the lucrative Chinese market and contribute to the development of one of Beijing's most iconic landmarks.

Another significant strategic partnership is Wu's collaboration with Hutchison Whampoa. In 2002, Hopewell Holdings and Hutchison Whampoa formed a joint venture to develop the Tsing Yi Container Terminal in Hong Kong. This partnership allowed Hopewell Holdings to expand its presence in the logistics sector and benefit from the growing demand for container shipping in Hong Kong.

Wu's strategic partnerships have not only increased his net worth but have also contributed to the economic development of Hong Kong and China. His ability to form and maintain strategic partnerships is a key factor in his success as a businessman and investor.

The connection between Wu's strategic partnerships and his net worth is clear. By forming strategic partnerships with other businesses, Wu has been able to expand his business empire, generate additional revenue streams, and contribute to the development of major infrastructure projects. These strategic partnerships have played a significant role in building Gordon Wu's net worth and making him one of the wealthiest people in Hong Kong.

Government contracts

Government contracts have been a significant contributor to Gordon Wu's net worth and the growth of Hopewell Holdings. By securing numerous government contracts for infrastructure projects, Hopewell Holdings has been able to generate substantial revenue and expand its operations.

One of the key benefits of government contracts is that they often involve long-term projects with guaranteed payments. This provides a stable source of revenue for Hopewell Holdings, which can then be used to fund further growth and expansion. In addition, government contracts often involve large-scale projects that require specialized expertise and resources. Hopewell Holdings' ability to secure and successfully execute these projects has demonstrated its strong capabilities and reputation in the industry.

Furthermore, government contracts can provide Hopewell Holdings with a competitive advantage over other companies. By having a track record of successful project execution and a strong relationship with government agencies, Hopewell Holdings is well-positioned to secure additional contracts in the future.

The connection between government contracts and Gordon Wu's net worth is clear. By securing numerous government contracts for infrastructure projects, Hopewell Holdings has been able to generate significant revenue, expand its operations, and gain a competitive advantage in the industry. These factors have all contributed to Gordon Wu's net worth and made him one of the wealthiest people in Hong Kong.

Property portfolio

Gordon Wu's substantial property portfolio in Hong Kong and other parts of Asia is a significant component of his vast net worth. Real estate investments have played a crucial role in building and increasing Wu's wealth over the years.

One of the key reasons for the importance of Wu's property portfolio is its consistent generation of rental income. By leasing out residential, commercial, and industrial properties, Wu earns a steady stream of revenue that contributes to his overall net worth. Moreover, the value of properties tends to appreciate over time, especially in prime locations such as Hong Kong. This capital appreciation further enhances Wu's wealth as the value of his property portfolio increases.

Furthermore, Wu's property portfolio provides him with a diversified investment strategy. Real estate is considered a relatively stable asset class compared to stocks or bonds, which can be more volatile. By investing in both local and international properties, Wu reduces his exposure to any one particular market or economic downturn. This diversification helps to preserve and grow his net worth in the long run.

In summary, Gordon Wu's substantial property portfolio is a vital component of his net worth. It provides him with consistent rental income, potential capital appreciation, and diversification benefits. Wu's strategic investments in real estate have been instrumental in his success as one of the wealthiest individuals in Hong Kong.

Art collection

Gordon Wu's extensive art collection is not only a testament to his passion for art but also a valuable component of his vast net worth. His collection includes masterpieces by renowned artists such as Pablo Picasso and Zhang Daqian, which have significantly appreciated in value over time.

The connection between Wu's art collection and his net worth is multifaceted. Firstly, the value of art as an asset class has historically outperformed inflation. By investing in high-quality artworks, Wu has effectively preserved and increased his wealth over the long term. Secondly, the prestige associated with owning rare and valuable artworks can enhance Wu's reputation and social status, which can have positive implications for his business ventures and overall net worth.

Moreover, Wu's art collection provides him with diversification benefits. Unlike stocks or bonds, which are susceptible to market fluctuations, fine art tends to be less correlated with other asset classes. This diversification helps to reduce the overall risk of Wu's investment portfolio and contributes to the stability of his net worth.

In summary, Gordon Wu's art collection is an important component of his net worth, providing him with long-term value appreciation, diversification benefits, and reputational advantages. His strategic investments in art have contributed to his overall financial success and solidified his position as one of the wealthiest individuals in Hong Kong.

Philanthropy

Gordon Wu's philanthropic endeavors are not only a reflection of his compassion but also a strategic component of his overall net worth management.

- Tax Benefits: Charitable donations can provide significant tax deductions, reducing Wu's tax liability and preserving his net worth. This allows him to maximize the impact of his wealth while simultaneously supporting worthy causes.

- Reputation Management: Philanthropy enhances Wu's public image and reputation, which can have positive implications for his business ventures and investments. A strong reputation can attract investors, partners, and customers, ultimately contributing to his overall net worth.

- Legacy Building: Through philanthropy, Wu is creating a lasting legacy that extends beyond his lifetime. By supporting charitable organizations and causes close to his heart, he is making a meaningful impact on society and ensuring that his values and beliefs continue to be upheld.

- Diversification: Philanthropy can be viewed as a form of alternative investment, providing diversification to Wu's overall portfolio. By directing funds towards charitable causes, he is spreading his risk and potentially reducing the volatility of his net worth.

In conclusion, Gordon Wu's philanthropy is not merely an act of generosity but a strategic element of his net worth management. It allows him to reduce tax liability, enhance his reputation, build a lasting legacy, and diversify his portfolio. These factors collectively contribute to the preservation and growth of his vast wealth.

FAQs on Gordon Wu's Net Worth

Gordon Wu's vast net worth has been the subject of much discussion and curiosity. This section addresses some frequently asked questions to provide a deeper understanding of his wealth and its sources.

Question 1: How did Gordon Wu accumulate his wealth?

Answer: Gordon Wu's wealth primarily stems from his successful business ventures, particularly through Hopewell Holdings. His strategic investments in property development, infrastructure, and telecommunications have been major contributors to his fortune.

Question 2: What is the estimated value of Gordon Wu's net worth?

Answer: As of 2023, Gordon Wu's net worth is estimated to be around $4.3 billion. This figure is subject to fluctuations based on market conditions and changes in the value of his assets.

Question 3: What is the significance of Gordon Wu's property portfolio?

Answer: Gordon Wu's substantial property portfolio in Hong Kong and other parts of Asia is a significant asset that contributes to his overall net worth. The rental income and capital appreciation from these properties provide a stable source of revenue and enhance the value of his wealth.

Question 4: How does Gordon Wu's philanthropy impact his net worth?

Answer: Gordon Wu's philanthropic endeavors, while driven by his desire to make a positive impact, also play a role in managing his net worth. Charitable donations offer tax benefits and can enhance his reputation, ultimately contributing to the preservation and growth of his wealth.

Question 5: What is the role of Hopewell Holdings in Gordon Wu's net worth?

Answer: Hopewell Holdings, founded by Gordon Wu, is the primary driver behind his vast net worth. The company's success in property development, infrastructure, and telecommunications has generated significant revenue and contributed to Wu's wealth.

Question 6: How has Gordon Wu's business acumen contributed to his net worth?

Answer: Gordon Wu's business acumen and ability to identify profitable opportunities have been crucial in building his net worth. His strategic investments, partnerships, and execution of large-scale projects have played a pivotal role in his financial success.

Summary: Gordon Wu's net worth is a result of his astute business sense, diversified investments, strategic partnerships, and significant property portfolio. His philanthropic endeavors, while driven by a desire to make a positive impact, also contribute to his overall net worth management.

Transition: This comprehensive overview of Gordon Wu's net worth sheds light on its sources, growth, and significance in the context of his business ventures and personal values.

Tips for Building Wealth Like Gordon Wu

Gordon Wu's remarkable net worth is a testament to his astute business acumen and strategic investments. Here are five key tips inspired by his approach:

Tip 1: Identify and capitalize on profitable opportunities: Wu's success can be attributed to his ability to identify undervalued assets and growth opportunities. Conduct thorough research, consult experts, and stay informed about market trends to uncover potential investments.

Tip 2: Build a diversified portfolio: Wu's wealth is spread across various asset classes, including property, infrastructure, telecommunications, and art. Diversifying your portfolio reduces risk and enhances overall returns.

Tip 3: Cultivate strategic partnerships: Wu's collaborations with China Resources and Hutchison Whampoa have been instrumental in his success. Seek out partnerships that complement your strengths and expand your reach.

Tip 4: Invest in long-term projects: Wu's investments often span many years, allowing them to compound and grow in value. Embrace a long-term investment horizon to maximize your returns.

Tip 5: Consider the value of philanthropy: Wu's philanthropic endeavors have not only benefited society but have also played a role in managing his net worth through tax deductions and reputation enhancement.

Summary: Building wealth requires a combination of sound investment decisions, strategic partnerships, and a long-term perspective. By following these tips inspired by Gordon Wu's approach, you can increase your chances of financial success.

Transition: Understanding the strategies behind Gordon Wu's net worth provides valuable insights for anyone seeking to build their own financial legacy.

Conclusion

Gordon Wu's net worth stands as a testament to his exceptional business acumen and strategic investments. By identifying undervalued assets, building a diversified portfolio, cultivating strategic partnerships, investing in long-term projects, and engaging in philanthropy, Wu has amassed a vast fortune.

The analysis of Wu's net worth not only provides insights into his financial success but also offers valuable lessons for aspiring investors. By emulating Wu's approach, individuals can increase their chances of building their own financial legacy. The key takeaways lie in recognizing profitable opportunities, diversifying investments, forming strategic alliances, embracing a long-term perspective, and considering the multifaceted benefits of philanthropy.