Troy Taylor Net Worth refers to the total value of the assets and income of an individual named Troy Taylor. It encompasses all financial holdings, including cash, investments, real estate, and other valuable possessions.

Determining an individual's net worth is significant for several reasons. It provides an overall financial snapshot, allowing for informed decision-making regarding investments, budgeting, and financial planning. Additionally, it can be used as an indicator of an individual's financial success and stability.

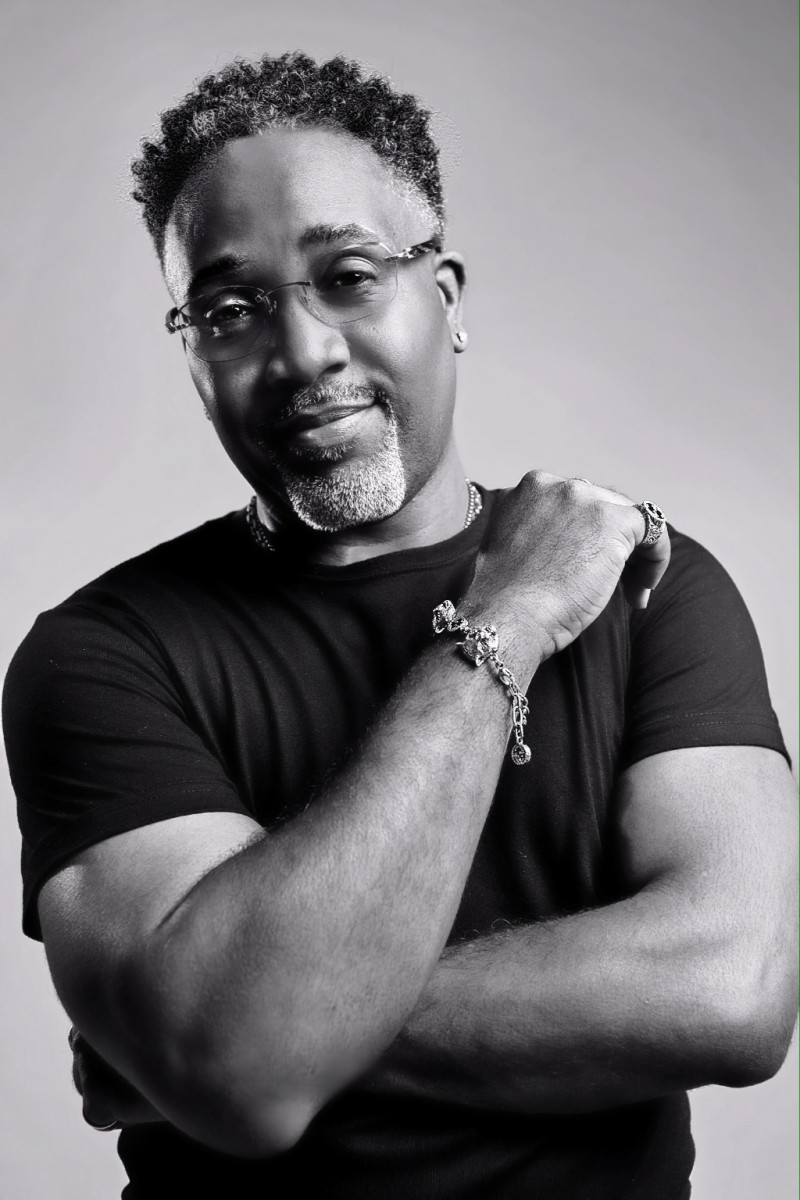

Troy Taylor's net worth has gained prominence due to his notable achievements and contributions in various fields. As a successful entrepreneur, investor, or public figure, his financial status has garnered public interest and curiosity.

Read also:Cheetah Club Sarasota Florida

Troy Taylor Net Worth

Understanding Troy Taylor's net worth requires examining various key aspects that contribute to his overall financial standing. These aspects highlight different dimensions of his wealth and provide insights into his financial success.

- Assets: Properties, investments, and valuable possessions.

- Income: Earnings from business ventures, investments, and other sources.

- Investments: Stocks, bonds, real estate, and other financial instruments.

- Business ventures: Ownership and equity in companies or enterprises.

- Endorsements and partnerships: Collaborations and agreements with brands or organizations.

- Brand value: Recognition and reputation that contributes to earning potential.

- Financial planning: Strategies and decisions related to wealth management.

- Tax implications: Liabilities and obligations related to taxes on income and assets.

- Lifestyle expenses: Personal and household expenditures that impact net worth.

These key aspects are interconnected and influence Troy Taylor's net worth in dynamic ways. His assets and income generate wealth, while investments and business ventures contribute to its growth. Brand value, endorsements, and financial planning play crucial roles in maintaining and increasing his net worth over time. Understanding these aspects provides a comprehensive view of Troy Taylor's financial status and the factors that shape it.

Assets

Assetswhich encompass properties, investments, and valuable possessionsplay a fundamental role in determining Troy Taylor's net worth. Properties, such as real estate and land, represent significant financial holdings that contribute to his overall wealth. Investments in stocks, bonds, mutual funds, and other financial instruments further enhance his net worth and provide potential for growth over time. Valuable possessions, including artwork, jewelry, and collectibles, can also add to his net worth, especially if they appreciate in value.

The significance of assets in Troy Taylor's net worth lies in their ability to generate income, appreciate in value, and provide financial security. Rental income from properties, dividends from investments, and the potential sale of valuable possessions can all contribute to his wealth. Moreover, assets can act as a buffer against financial downturns, providing a safety net during challenging economic times.

Understanding the connection between assets and Troy Taylor's net worth is crucial for gaining insights into his financial standing. By analyzing the types and value of his assets, we can assess his financial strength, risk tolerance, and overall investment strategy. This understanding is essential for investors, creditors, and business partners who seek to engage with Troy Taylor in financial transactions.

Income

The connection between "Income: Earnings from business ventures, investments, and other sources" and "troy taylor net worth" is crucial in understanding his overall financial status. Income represents the inflow of funds that contribute directly to his net worth.

Read also:Billy Milligan The Extraordinary Story Of A Man With 24 Different Personalities

- Business ventures: Earnings from Troy Taylor's business ventures, such as profits from companies he owns or invests in, contribute significantly to his net worth. Success in business ventures leads to increased income and wealth accumulation.

- Investments: Income from investments, such as dividends from stocks, interest from bonds, and rental income from real estate, provides a steady stream of passive income that augments Troy Taylor's net worth. Wise investment decisions can result in substantial wealth growth over time.

- Other sources: Additional income streams, such as royalties from intellectual property, consulting fees, or speaking engagements, can further contribute to Troy Taylor's net worth. Diversifying income sources enhances financial stability and overall wealth.

Understanding the composition and stability of Troy Taylor's income is essential for assessing his financial health. Consistent and growing income allows him to maintain and increase his net worth, while fluctuations or downturns in income can impact his overall financial standing. Analyzing income sources provides insights into Troy Taylor's business acumen, investment strategies, and overall financial management skills.

Investments

The connection between "Investments: Stocks, bonds, real estate, and other financial instruments" and "troy taylor net worth" is significant in understanding his overall financial standing. Investments represent a crucial component of his net worth, contributing to its growth and stability over time.

Stocks, bonds, real estate, and other financial instruments offer Troy Taylor various opportunities to increase his wealth. Stocks represent ownership in companies, and their value fluctuates based on the company's performance. Bonds provide fixed income through regular interest payments and are considered less risky compared to stocks. Real estate, including land and property, can generate rental income and appreciate in value over time. Other financial instruments, such as mutual funds and hedge funds, offer diversification and potential for growth.

Troy Taylor's investment strategy plays a vital role in determining the performance of his net worth. Diversification across different asset classes and investments reduces risk and enhances the potential for long-term wealth accumulation. Understanding the connection between investments and Troy Taylor's net worth provides insights into his financial acumen, risk tolerance, and overall investment philosophy.

Business ventures

The connection between "Business ventures: Ownership and equity in companies or enterprises" and "troy taylor net worth" is significant in understanding his overall financial standing and wealth accumulation. Business ventures are a substantial component of Troy Taylor's net worth, contributing to its growth and stability over time.

- Ownership and equity: Troy Taylor's ownership and equity in companies or enterprises represent a significant portion of his net worth. As an entrepreneur or investor, his success in business ventures directly impacts his overall wealth.

- Profitability: The profitability of Troy Taylor's business ventures is a key factor in determining the growth of his net worth. Successful ventures generate profits that can be reinvested or distributed as dividends, increasing his overall wealth.

- Growth potential: Troy Taylor's business ventures can contribute to his net worth through their growth potential. High-growth ventures have the potential to increase in value significantly over time, leading to substantial wealth creation.

- Diversification: Business ventures offer diversification benefits for Troy Taylor's net worth. Investing in multiple ventures reduces risk and enhances the stability of his overall wealth.

Understanding the connection between business ventures and Troy Taylor's net worth provides insights into his entrepreneurial endeavors, risk appetite, and overall financial strategy. Successful business ventures can be a significant driver of wealth accumulation and contribute to long-term financial security.

Endorsements and partnerships

The connection between "Endorsements and partnerships: Collaborations and agreements with brands or organizations" and "troy taylor net worth" is significant in understanding the various sources of income that contribute to his overall wealth. Endorsements and partnerships involve Troy Taylor collaborating with brands or organizations to promote their products or services in exchange for compensation.

These collaborations and agreements can take various forms, such as sponsored content on social media, product placements in videos or blog posts, and exclusive partnerships for promotional campaigns. The value of these endorsements and partnerships depends on factors such as Troy Taylor's reach, engagement, and reputation within his target audience.

For Troy Taylor, endorsements and partnerships provide an additional revenue stream that can supplement his income from other sources such as business ventures and investments. These collaborations can also enhance his brand value and visibility, leading to potential growth opportunities in the future.

Brand value

The connection between "Brand value: Recognition and reputation that contributes to earning potential" and "troy taylor net worth" is significant in understanding how Troy Taylor leverages his personal brand to generate income and increase his overall wealth.

Brand value encompasses the recognition, reputation, and perception of Troy Taylor as a public figure or professional. A strong brand value allows him to command higher fees for endorsements, partnerships, and public appearances. Troy Taylor's expertise, accomplishments, and personal qualities contribute to his brand value, making him an attractive partner for brands and organizations seeking to align themselves with his image and values.

For example, Troy Taylor's reputation as a successful entrepreneur and investor has led to lucrative endorsement deals with companies in various industries. His ability to influence consumer behavior and drive product sales through his recommendations and endorsements directly contributes to his earning potential and, consequently, his net worth.

Moreover, Troy Taylor's brand value extends beyond traditional endorsements and partnerships. His personal brand has become a platform for him to launch new ventures, such as online courses, consulting services, and merchandise. By leveraging his recognition and reputation, he can generate multiple income streams, further increasing his net worth.

Understanding the connection between brand value and Troy Taylor's net worth highlights the importance of reputation management and personal branding. By carefully cultivating his image and establishing himself as an expert in his field, Troy Taylor has created a valuable asset that contributes significantly to his overall wealth.

Financial planning

Financial planning encompasses the strategies and decisions that Troy Taylor employs to manage his wealth and secure his financial future. It involves a comprehensive approach to managing income, expenses, savings, investments, and other financial resources.

- Investment diversification: Troy Taylor's financial plan likely involves diversifying his investments across various asset classes, such as stocks, bonds, real estate, and alternative investments. This strategy aims to reduce risk and enhance the overall stability of his portfolio.

- Tax optimization: Effective financial planning considers tax implications and seeks to minimize tax liability. Troy Taylor's plan may include strategies such as utilizing tax-advantaged accounts, maximizing deductions, and planning for capital gains.

- Retirement planning: As part of his long-term financial plan, Troy Taylor likely has strategies in place to ensure a comfortable retirement. This may involve contributing to retirement accounts, investing for growth, and planning for healthcare expenses.

- Estate planning: Troy Taylor's financial plan may include provisions for estate planning, ensuring the orderly distribution of his assets after his passing. This can involve creating a will or trust, appointing an executor, and minimizing estate taxes.

Through careful financial planning, Troy Taylor can maximize the growth of his net worth while mitigating risks and ensuring his long-term financial well-being. His financial plan is a roadmap that guides his financial decisions and helps him achieve his financial goals.

Tax implications

Tax implications play a significant role in shaping Troy Taylor's net worth. Taxes on income and assets can affect his financial standing and influence his financial planning decisions.

- Income taxes: Troy Taylor's income from various sources, such as business ventures, investments, and endorsements, is subject to income taxes. The amount of tax he owes depends on his income level and tax bracket.

- Capital gains taxes: When Troy Taylor sells assets, such as stocks or real estate, he may incur capital gains taxes. The tax rate depends on the length of time he held the asset and his overall income.

- Property taxes: Troy Taylor's ownership of real estate incurs property taxes. These taxes are typically based on the assessed value of the property.

- Estate taxes: Upon Troy Taylor's passing, his estate may be subject to estate taxes. The estate tax is levied on the value of his assets after deducting allowable expenses and exemptions.

Effective tax planning is crucial for Troy Taylor to minimize his tax liability and preserve his net worth. He likely employs strategies such as maximizing tax-deductible contributions, utilizing tax-advantaged accounts, and seeking professional advice from tax experts. Understanding the tax implications ensures that Troy Taylor's financial plan is optimized and his wealth is protected.

Lifestyle expenses

Lifestyle expenses refer to the personal and household expenditures that an individual incurs on a regular basis. These expenses include necessities such as housing, food, transportation, and healthcare, as well as discretionary expenses such as entertainment, travel, and hobbies.

For Troy Taylor, lifestyle expenses play a significant role in determining his net worth. High levels of spending can erode his wealth over time, while responsible spending and saving can contribute to its growth. Understanding the connection between lifestyle expenses and net worth is crucial for Troy Taylor to make informed financial decisions and maintain his financial well-being.

One key aspect of lifestyle expenses is their impact on cash flow. Excessive spending can lead to a negative cash flow, where expenses exceed income, which can make it difficult to save and invest. Conversely, managing expenses effectively can free up more cash flow for savings and investments, which can contribute to Troy Taylor's net worth growth.

Furthermore, lifestyle expenses can influence Troy Taylor's financial planning and retirement goals. Early in his career, prioritizing saving and investing over excessive spending can help him accumulate wealth and secure his financial future. As he approaches retirement, adjusting lifestyle expenses to align with his retirement income and goals becomes increasingly important.

In summary, understanding the connection between lifestyle expenses and net worth is essential for Troy Taylor to effectively manage his finances and achieve his financial goals. Responsible spending, saving, and investing can contribute to his net worth growth and long-term financial security.

FAQs on Troy Taylor Net Worth

Understanding Troy Taylor's net worth requires examining various key aspects that contribute to his overall financial standing. These aspects highlight different dimensions of his wealth and provide insights into his financial success.

Question 1: What factors contribute to Troy Taylor's net worth?

Troy Taylor's net worth encompasses his total assets, including properties, investments, and valuable possessions, minus any liabilities or debts. His income from business ventures, investments, and endorsements further contributes to his net worth, as does his brand value and financial planning strategies.

Question 2: How does Troy Taylor generate income?

Troy Taylor generates income through various sources, including profits from his business ventures, dividends and interest from investments, and compensation for endorsements and partnerships. His income streams contribute significantly to his overall net worth.

Question 3: What is the significance of investments in Troy Taylor's net worth?

Investments play a crucial role in enhancing Troy Taylor's net worth. Stocks, bonds, real estate, and other financial instruments offer diversification and growth potential, contributing to the overall value of his assets. Wise investment decisions can lead to substantial wealth accumulation over time.

Question 4: How does Troy Taylor's brand value impact his net worth?

Troy Taylor's brand value, encompassing his recognition, reputation, and influence, enables him to command higher fees for endorsements, partnerships, and public appearances. By leveraging his personal brand, he can generate additional income streams and enhance his overall net worth.

Question 5: What is the role of financial planning in Troy Taylor's net worth management?

Effective financial planning is essential for Troy Taylor to manage his wealth and secure his financial future. Strategies such as investment diversification, tax optimization, retirement planning, and estate planning contribute to the growth and preservation of his net worth.

Question 6: How do lifestyle expenses affect Troy Taylor's net worth?

Troy Taylor's lifestyle expenses, including personal and household expenditures, influence his net worth. Responsible spending and saving habits can contribute to wealth accumulation, while excessive spending can erode his financial standing over time. Managing lifestyle expenses is crucial for long-term financial security.

Summary: Troy Taylor's net worth is a reflection of his overall financial status, encompassing assets, income, investments, brand value, financial planning strategies, and lifestyle expenses. Understanding the interplay of these factors provides valuable insights into his wealth management and financial success.

Next Article Section: Troy Taylor's Business Ventures and Investment Strategies

Understanding Troy Taylor's Net Worth

Understanding Troy Taylor's net worth and the factors that contribute to it can provide valuable insights for individuals seeking to enhance their own financial well-being. Here are several key tips to consider:

Tip 1: Diversify Income Streams

Relying on a single source of income can be risky. By diversifying income streams through business ventures, investments, and endorsements, individuals can mitigate financial risks and increase their earning potential.

Tip 2: Invest Wisely

Investing in a mix of asset classes, such as stocks, bonds, and real estate, can help individuals grow their wealth over time. Researching investment options and seeking professional advice can increase the likelihood of successful investments.

Tip 3: Build a Strong Brand

Establishing a strong personal brand can enhance earning potential through endorsements, partnerships, and public appearances. Focusing on building a reputation for expertise, credibility, and influence can lead to increased financial opportunities.

Tip 4: Plan for the Future

Effective financial planning is essential for long-term financial security. Setting financial goals, creating a budget, and implementing tax optimization strategies can help individuals manage their wealth wisely and prepare for the future.

Tip 5: Manage Lifestyle Expenses

Controlling lifestyle expenses and avoiding excessive spending can contribute to financial growth. Creating a budget, prioritizing needs over wants, and seeking ways to reduce expenses can help individuals maintain a healthy financial balance.

Tip 6: Seek Professional Advice

Consulting with financial advisors, tax experts, and other professionals can provide valuable guidance and support. Seeking professional advice can help individuals make informed financial decisions and maximize their wealth-building strategies.

Summary: Understanding Troy Taylor's net worth highlights the importance of diversifying income streams, investing wisely, building a strong brand, planning for the future, managing lifestyle expenses, and seeking professional advice. By implementing these tips, individuals can increase their financial success and achieve their financial goals.

Conclusion

Troy Taylor's net worth is a testament to his financial acumen, savvy investments, and strategic planning. By examining the key aspects that contribute to his wealth, we gain valuable insights into the factors that drive financial success.

Understanding Troy Taylor's net worth extends beyond mere curiosity about his financial status. It serves as a reminder that wealth accumulation is a journey that requires a multifaceted approach. By diversifying income, investing wisely, building a strong personal brand, planning for the future, and managing lifestyle expenses, individuals can increase their financial well-being and achieve their own financial aspirations.