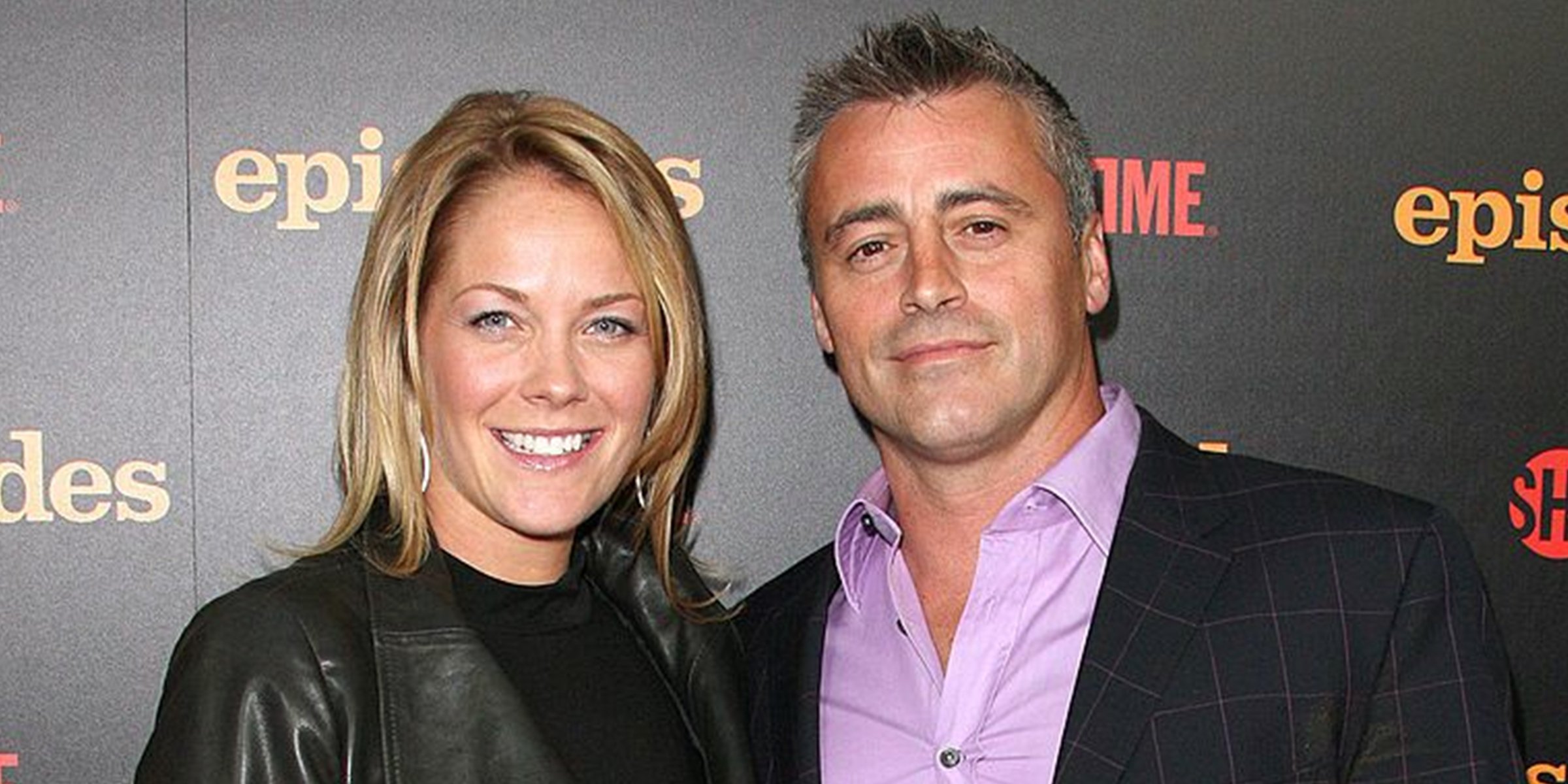

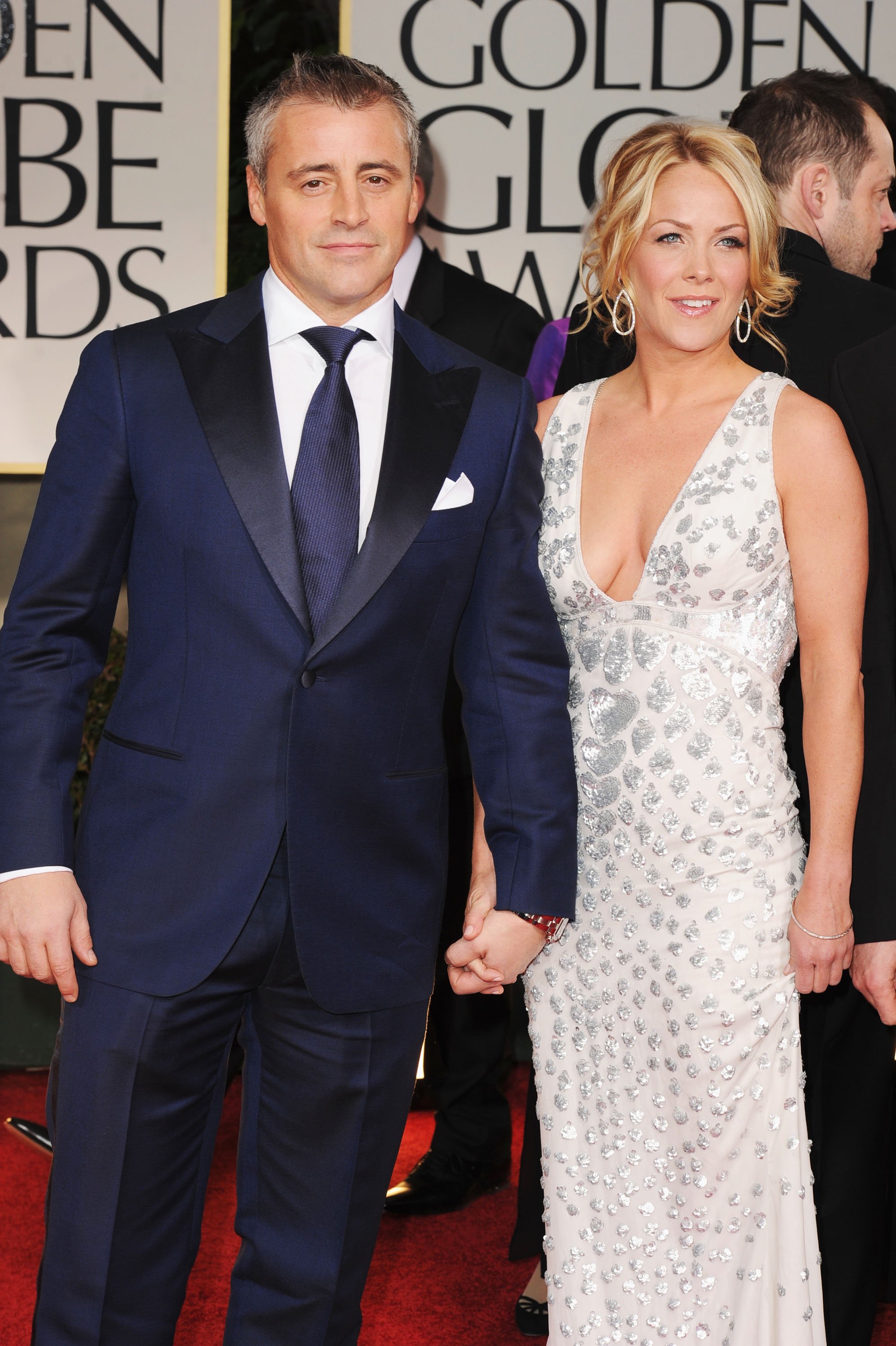

Melissa McKnight Net Worth refers to the total value of all her assets, including investments, property, and cash, minus any outstanding debts or liabilities.

Determining an accurate estimate of Melissa McKnight's net worth can be challenging due to limited publicly available information. However, various sources suggest that her net worth is estimated to be in the millions of dollars, primarily accumulated through her successful career as a television host and journalist.

McKnight's net worth is a testament to her hard work, dedication, and financial savvy. It serves as a reminder of the potential financial rewards that can come with success in the entertainment industry.

Read also:Is Maddy Smith Married Exploring The Life And Relationship Status Of A Rising Star

Melissa McKnight Net Worth

Melissa McKnight's net worth encompasses several key aspects that contribute to her overall financial standing. These aspects include:

- Assets: Investments, property, cash.

- Earnings: Income from television hosting, journalism.

- Investments: Stocks, bonds, real estate.

- Properties: Residential, commercial.

- Cash: Liquid assets, savings.

- Liabilities: Debts, loans.

- Expenses: Living costs, business expenses.

- Financial Management: Strategies for wealth accumulation and preservation.

These aspects are interconnected and influence Melissa McKnight's overall net worth. Her earnings from her successful career as a television host and journalist contribute significantly to her wealth. Her investments and properties further enhance her financial portfolio. Effective financial management ensures that her assets continue to grow and liabilities are minimized, resulting in a substantial net worth.

| Name: | Melissa McKnight |

| Occupation: | Television host, journalist |

| Net Worth: | Estimated to be in the millions of dollars |

Assets

Assets, including investments, property, and cash, play a fundamental role in determining Melissa McKnight's net worth. Assets represent the resources and valuables that contribute to her overall financial standing.

Investments, such as stocks, bonds, and mutual funds, offer the potential for growth and passive income. McKnight's investment portfolio contributes to her net worth by increasing the value of her assets over time. Property, including residential and commercial real estate, is another significant asset class. Properties provide rental income, potential capital appreciation, and diversification benefits. Cash, including savings accounts and money market accounts, offers liquidity and stability to McKnight's financial portfolio.

The combination of investments, property, and cash contributes to Melissa McKnight's overall net worth. Managing these assets effectively is crucial for preserving and growing her wealth. Diversification, regular monitoring, and strategic decision-making are essential aspects of asset management.

Earnings

Earnings, primarily from Melissa McKnight's successful career as a television host and journalist, represent a crucial component of her net worth. The income she generates through her professional endeavors directly contributes to her overall financial standing.

Read also:Date Night Ideas Mn

Television hosting and journalism provide McKnight with a steady stream of income, allowing her to accumulate wealth over time. Her expertise, experience, and reputation in the industry enable her to command high salaries and negotiate lucrative contracts.

The stability and growth potential of McKnight's earnings contribute significantly to her net worth. Consistent income provides a solid foundation for financial planning, investments, and asset acquisition. As her career progresses and her earning potential increases, her net worth is likely to grow accordingly.

Investments

Investments, including stocks, bonds, and real estate, play a significant role in shaping Melissa McKnight's net worth. These investment vehicles offer potential growth, passive income, diversification, and tax benefits, contributing to her overall financial well-being.

- Stocks: Stocks represent ownership shares in publicly traded companies. Investing in stocks offers the potential for capital appreciation and dividends, providing McKnight with long-term growth opportunities and income.

- Bonds: Bonds are fixed-income securities that provide regular interest payments and return the principal amount at maturity. McKnight's bond investments offer stability and diversification to her portfolio, generating a steady stream of income.

- Real estate: Investing in residential or commercial properties can provide rental income, potential capital appreciation, and tax advantages. McKnight's real estate holdings contribute to her net worth by generating passive income and appreciating in value over time.

Melissa McKnight's investment strategy is likely diversified across these asset classes, balancing risk and return to optimize her net worth. Her investment decisions are influenced by factors such as market conditions, economic outlook, and her personal financial goals.

Properties

Properties, including residential and commercial real estate, contribute significantly to Melissa McKnight's net worth. Investing in properties offers several financial benefits that enhance her overall financial standing.

Residential properties, such as houses or apartments, can generate rental income, providing a steady stream of passive income for McKnight. Additionally, residential properties have the potential for capital appreciation over time, increasing her net worth. Commercial properties, such as office buildings or retail spaces, offer similar benefits, with the added potential for higher rental yields and long-term value growth.

The value of McKnight's properties is influenced by various factors, including location, market conditions, and property type. By carefully selecting and managing her property investments, McKnight can optimize her net worth and generate substantial returns.

Cash

Cash, including liquid assets and savings, plays a crucial role in Melissa McKnight's net worth and overall financial well-being. Liquid assets refer to funds that can be easily converted into cash, such as checking accounts, money market accounts, and short-term certificates of deposit. Savings, on the other hand, typically include funds set aside for future goals or emergencies, and are often held in savings accounts or bonds.

The importance of cash in Melissa McKnight's net worth stems from its liquidity and flexibility. Liquid assets provide immediate access to funds for various purposes, such as covering unexpected expenses, making investments, or seizing business opportunities. Savings, while less liquid, offer a buffer against financial emergencies and can serve as a source of funds for long-term goals. By maintaining a healthy balance of cash and savings, McKnight can navigate financial challenges, capitalize on opportunities, and preserve her net worth.

In summary, cash and savings are essential components of Melissa McKnight's net worth, providing liquidity, stability, and flexibility. Effective cash management and strategic savings habits contribute to her overall financial security and well-being.

Liabilities

Liabilities, including debts and loans, represent obligations that Melissa McKnight owes to other individuals or institutions. These liabilities have a direct impact on her net worth, as they reduce the overall value of her assets.

Debts, such as credit card balances and personal loans, can accumulate over time, especially if not managed responsibly. High levels of debt can strain McKnight's cash flow and make it challenging to save or invest. Additionally, interest payments on debts can further erode her net worth.

Loans, such as mortgages or business loans, are often necessary for significant purchases or investments. However, it's important to carefully consider the terms and conditions of loans to ensure they align with McKnight's financial goals and ability to repay. Unmanageable loan payments can lead to financial distress and negatively impact her net worth.

Effective management of liabilities is crucial for Melissa McKnight to preserve and grow her net worth. This includes staying within a reasonable debt-to-income ratio, making timely payments, and exploring debt consolidation or refinancing options when necessary. By minimizing liabilities and prioritizing debt repayment, McKnight can improve her financial health and increase her overall net worth.

Expenses

Expenses, encompassing living costs and business expenses, play a significant role in shaping Melissa McKnight's net worth. These expenses represent the consumption of resources and incurrence of obligations that reduce her overall financial standing.

Living costs, including housing, food, transportation, and healthcare, are essential for McKnight's well-being and quality of life. These expenses must be carefully managed to ensure her financial stability and avoid excessive depletion of her assets. By optimizing her living expenses, McKnight can allocate more funds towards savings, investments, and debt repayment, ultimately increasing her net worth.

Business expenses, incurred in the course of McKnight's professional activities, are alsoThese expenses may include office rent, equipment, staff salaries, and marketing costs. Managing business expenses effectively is crucial for maximizing profits and ensuring the sustainability of her income streams. By carefully controlling expenses and optimizing revenue, McKnight can enhance her net worth through increased profitability.

Understanding the connection between expenses and net worth is essential for Melissa McKnight's long-term financial success. By diligently managing her living costs and business expenses, she can minimize financial outflows, allocate more resources towards wealth-building activities, and ultimately increase her overall net worth.

Financial Management

Financial management is a crucial aspect of preserving and growing wealth, making it highly relevant to discussions of Melissa McKnight's net worth. Effective financial management involves implementing strategies that optimize income, minimize expenses, and maximize returns on investments.

- Budgeting and Expense Tracking: Creating and adhering to a budget helps track income and expenses, ensuring that McKnight's spending aligns with her financial goals. It also enables her to identify areas where expenses can be reduced, freeing up more funds for saving and investing.

- Investment Planning: Deciding on an appropriate asset allocation strategy and diversifying investments across different asset classes help mitigate risk and optimize returns. McKnight's investment portfolio should align with her risk tolerance and long-term financial goals.

- Retirement Planning: Contributing to retirement accounts, such as 401(k)s and IRAs, allows McKnight to save for her future while taking advantage of tax benefits. This long-term planning helps ensure her financial security in retirement.

- Debt Management: Minimizing high-interest debt and prioritizing debt repayment can free up McKnight's cash flow and improve her overall financial standing. Utilizing strategies such as debt consolidation or refinancing can help reduce interest expenses and accelerate debt repayment.

By implementing these financial management strategies, Melissa McKnight can effectively accumulate and preserve her wealth. These strategies empower her to make informed financial decisions, optimize her financial resources, and ultimately increase her net worth over time.

FAQs about Melissa McKnight's Net Worth

Melissa McKnight is a well-known television host and journalist who has accumulated substantial wealth throughout her career. Here are answers to some frequently asked questions about her net worth:

Question 1: What is Melissa McKnight's net worth?

Melissa McKnight's net worth is estimated to be in the millions of dollars. Her earnings from her successful career as a television host and journalist, combined with her investments and properties, have contributed to her overall financial standing.

Question 2: How does Melissa McKnight earn her income?

Melissa McKnight's primary source of income is her work as a television host and journalist. She has hosted several popular television shows throughout her career, and her expertise and experience in the industry have allowed her to command high salaries and negotiate lucrative contracts.

Question 3: What are Melissa McKnight's investments?

Melissa McKnight has a diversified investment portfolio that includes stocks, bonds, and real estate. Her investments are aimed at generating growth, passive income, and long-term financial security.

Question 4: Does Melissa McKnight own any properties?

Yes, Melissa McKnight owns several properties, including residential and commercial real estate. Her real estate investments provide her with rental income, potential capital appreciation, and diversification benefits.

Question 5: How does Melissa McKnight manage her finances?

Melissa McKnight employs sound financial management strategies to preserve and grow her wealth. She focuses on budgeting, expense tracking, investment planning, retirement planning, and debt management to optimize her financial resources and make informed decisions.

Question 6: What can we learn from Melissa McKnight's financial success?

Melissa McKnight's financial success highlights the importance of hard work, dedication, and smart financial planning. By diversifying her income streams, investing wisely, and managing her finances effectively, she has built a substantial net worth and secured her financial future.

In summary, Melissa McKnight's net worth is a testament to her financial savvy and her ability to leverage her earnings and investments to achieve financial success. Her financial journey provides valuable lessons on building and preserving wealth for anyone seeking financial well-being.

This concludes our exploration of Melissa McKnight's net worth.

Transition to the next article section...

Tips Related to "Melissa McKnight Net Worth"

Understanding Melissa McKnight's net worth and the strategies she employs to manage her finances can provide valuable insights for individuals seeking to build and preserve wealth. Here are several key tips to consider:

Tip 1: Diversify Income Streams

Melissa McKnight's success stems from her ability to generate income from multiple sources, including her work as a television host and journalist, as well as her investments and properties. Diversifying income streams helps reduce reliance on a single source and provides financial stability.

Tip 2: Invest Wisely

McKnight's net worth has grown significantly through her strategic investments in stocks, bonds, and real estate. By carefully selecting and managing her investments, she optimizes her returns and mitigates potential risks.

Tip 3: Manage Expenses Effectively

McKnight's financial success is also attributed to her responsible expense management. Creating a budget, tracking expenses, and identifying areas for savings allows her to control her cash flow and allocate more funds towards investments and wealth-building activities.

Tip 4: Plan for Retirement

McKnight understands the importance of long-term financial planning. She contributes to retirement accounts, such as 401(k)s and IRAs, to secure her financial future and maintain her lifestyle in her later years.

Tip 5: Seek Professional Advice

McKnight likely consults with financial advisors to optimize her financial strategies. Seeking professional guidance can help individuals make informed decisions about investments, tax planning, and estate planning.

Summary:

Melissa McKnight's financial journey offers valuable lessons for anyone seeking to build and preserve wealth. By diversifying income streams, investing wisely, managing expenses effectively, planning for retirement, and seeking professional advice, individuals can increase their financial resilience and achieve their long-term financial goals.

This concludes our exploration of tips related to "Melissa McKnight Net Worth".

Transition to the article's conclusion...

Conclusion

Melissa McKnight's net worth stands as a testament to her financial acumen and unwavering commitment to building wealth. Through strategic diversification, sound investments, and prudent financial management, she has amassed a substantial fortune that secures her financial well-being.

Her journey offers valuable lessons for anyone seeking to achieve financial success. By emulating her principles of income diversification, wise investing, responsible expense management, and long-term planning, individuals can increase their financial resilience and work towards building a secure financial future.