Brandon Call Net Worth refers to the total value of the financial assets and liabilities owned by the American actor, Brandon Call. It encompasses his earnings from acting, investments, and other sources, minus any debts or obligations.

Understanding a celebrity's net worth provides insights into their financial success and career trajectory. It can be influenced by factors such as their popularity, the box office performance of their films, endorsement deals, and investments. Analyzing net worth can help fans, researchers, and industry professionals assess an actor's financial standing and the trajectory of their career.

To explore the topic of Brandon Call's net worth in more detail, we can delve into his acting career, notable roles, and any significant investments or business ventures he may have undertaken. This examination will provide a comprehensive understanding of how he has accumulated his wealth and the factors that have contributed to his financial success.

Read also:P Diddy Height Discovering The Iconic Rapper And Entrepreneurs Real Height

Brandon Call Net Worth

Understanding Brandon Call's net worth involves examining various aspects of his financial assets and liabilities:

- Earnings: Income from acting, including salaries, royalties, and residuals.

- Investments: Stocks, bonds, real estate, or other financial instruments.

- Assets: Property, vehicles, jewelry, or other valuable possessions.

- Endorsements: Partnerships with brands for promotional activities.

- Residual Income: Ongoing payments from past acting work, such as reruns or streaming.

- Debt: Mortgages, loans, or other financial obligations.

- Taxes: Income tax, property tax, or other government levies.

- Expenses: Living costs, travel, entertainment, or other personal expenditures.

- Lifestyle: Choices that influence spending habits and financial decisions.

- Financial Management: Strategies for managing wealth, including investments and tax planning.

These aspects collectively contribute to Brandon Call's net worth, providing insights into his financial success and career trajectory.

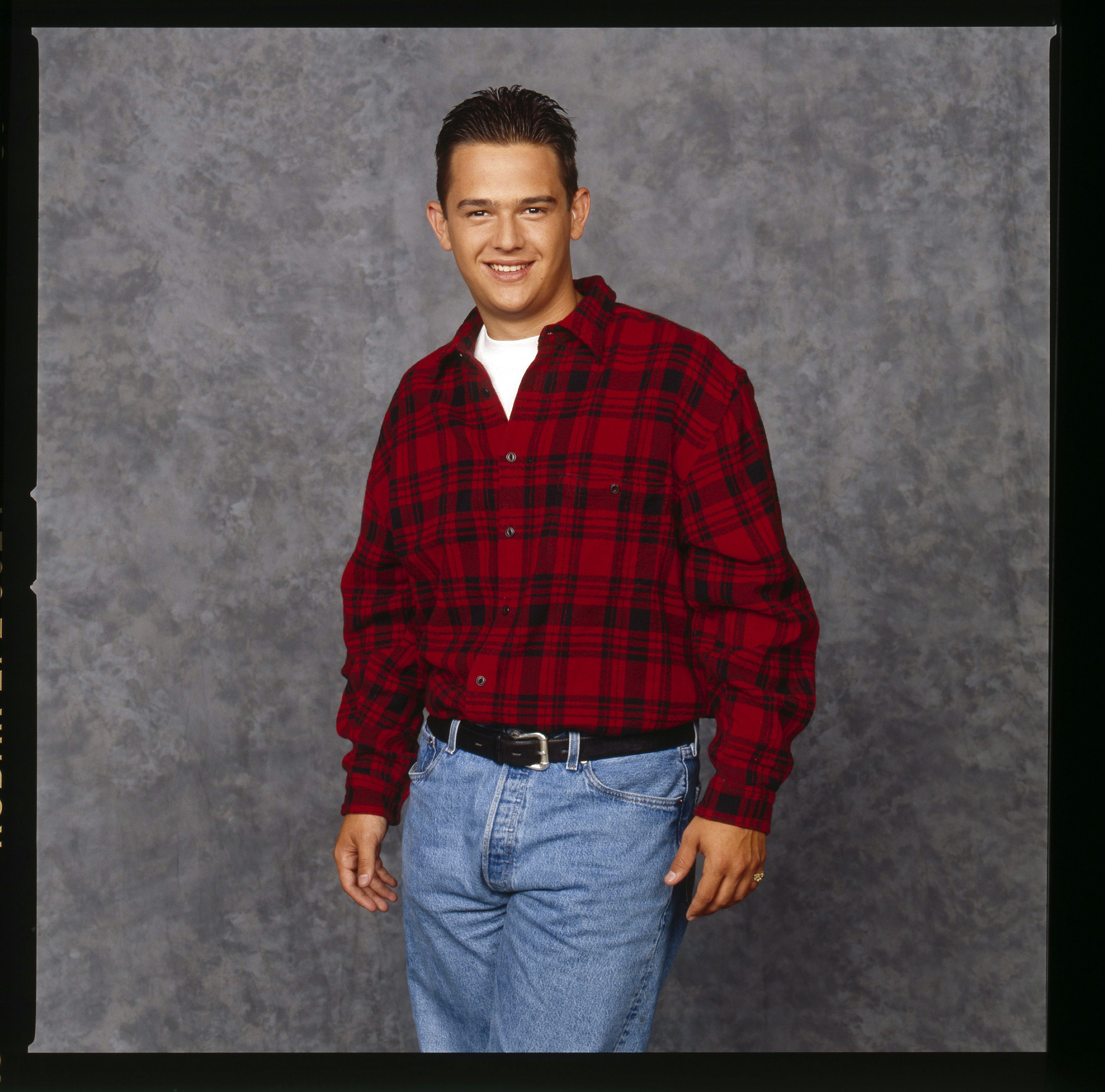

Brandon Call Personal Details and Bio Data:

| Full Name: | Brandon Call |

| Date of Birth: | November 17, 1976 |

| Place of Birth: | Torrance, California, U.S. |

| Occupation: | Actor |

| Years Active: | 1982-2012 |

| Known For: | The Hogan Family, Step by Step |

Earnings

Earnings from acting, encompassing salaries, royalties, and residuals, constitute a significant component of Brandon Call's net worth. Acting roles in films, television shows, and stage productions generate income that directly contributes to his financial assets.

Salaries are fixed amounts paid to actors for their work on a specific project, while royalties are ongoing payments based on the number of times their work is aired or sold. Residuals are payments made to actors each time their work is rebroadcast or reused in syndication, streaming, or other forms of distribution.

Understanding the connection between earnings from acting and Brandon Call's net worth is essential for assessing his financial success and career trajectory. It highlights the importance of consistent work, successful projects, and negotiation skills in shaping an actor's financial standing.

Read also:Wave Fest 2024

Investments

Investments in stocks, bonds, real estate, or other financial instruments represent a crucial component of Brandon Call's net worth. These investments contribute to his overall financial growth and long-term financial security.

Stocks represent ownership shares in publicly traded companies. Their value fluctuates based on market conditions and company performance. Bonds, on the other hand, are loans made to companies or governments that pay regular interest payments and return the principal amount at maturity. Real estate investments involve purchasing properties, either residential or commercial, with the potential for rental income, appreciation, or both.

Understanding the connection between investments and Brandon Call's net worth is essential for assessing his financial acumen and long-term financial planning. It highlights the importance of diversifying investments across different asset classes to mitigate risk and maximize returns. Successful investments can significantly increase an actor's net worth, providing financial stability and future opportunities.

Assets

Assets such as property, vehicles, jewelry, and other valuable possessions represent a significant component of Brandon Call's net worth, contributing to his overall financial standing and long-term wealth.

Real estate, including residential and commercial properties, is often a major asset class for actors. Properties can generate rental income, appreciate in value, or both, providing a stable source of passive income and potential capital gains. Vehicles, while depreciating assets, can also hold value and contribute to net worth, especially if they are collector's items or luxury models.

Jewelry and other valuable possessions, such as artwork or collectibles, can also add to an actor's net worth. These items may hold significant monetary value, especially if they are rare, unique, or have sentimental significance. Understanding the connection between assets and Brandon Call's net worth is essential for assessing his financial stability and long-term financial security. Assets provide a tangible representation of his wealth and serve as a foundation for future financial planning.

Endorsements

Endorsements, involving partnerships with brands for promotional activities, contribute to Brandon Call's net worth by leveraging his public image and influence to generate income. Brands seek to align themselves with celebrities who embody their values and resonate with their target audience, offering compensation in exchange for endorsements.

Endorsements can take various forms, including social media posts, product placements, appearances at events, and exclusive collaborations. Call's involvement in endorsement deals allows him to tap into his fan base and monetize his popularity, adding to his overall financial assets.

Understanding the connection between endorsements and Brandon Call's net worth is crucial for assessing his financial standing and diversification of income streams. Endorsements provide not only monetary benefits but also enhance his brand value and expand his reach, contributing to his long-term financial success.

Residual Income

Residual income, comprising ongoing payments from past acting work, such as reruns or streaming, plays a substantial role in shaping Brandon Call's net worth. This income stream provides a steady passive income, contributing significantly to his overall financial stability.

Reruns refer to subsequent broadcasts of previously aired television shows or movies, while streaming involves the distribution of content over the internet. Each time Call's past work is aired or streamed, he receives a portion of the revenue generated, ensuring a continuous flow of income.

Understanding the connection between residual income and Brandon Call's net worth highlights the importance of an actor's work extending beyond the initial production. Successful projects that continue to generate revenue through reruns or streaming can significantly boost an actor's net worth over time. It also emphasizes the value of building a strong filmography with enduring appeal.

Debt

Debt, encompassing mortgages, loans, or other financial obligations, represents an important consideration in assessing Brandon Call's net worth and overall financial health.

- Mortgages: Mortgages are loans secured by real estate, typically used to finance the purchase of a home. They involve regular payments of principal and interest, and understanding their impact on Call's net worth is crucial.

- Loans: Loans can come in various forms, such as personal loans, business loans, or lines of credit. These loans may be used for a range of purposes, from consolidating debt to funding investments. Analyzing the terms and interest rates of Call's loans is essential for comprehending their influence on his net worth.

- Other Financial Obligations: Beyond mortgages and loans, other financial obligations can include credit card debt, unpaid taxes, or legal judgments. Understanding the nature and extent of these obligations is vital in evaluating Call's overall financial situation.

The presence and management of debt can significantly impact Brandon Call's net worth. High levels of debt can strain his cash flow, limit his financial flexibility, and potentially hinder his ability to pursue new opportunities. Conversely, responsible debt management, such as timely payments and strategic refinancing, can help Call optimize his financial position and preserve his net worth.

Taxes

Taxes, encompassing income tax, property tax, or other government levies, represent a significant factor influencing Brandon Call's net worth and overall financial well-being.

- Income Tax: Income tax is levied on an individual's taxable income, and its rate structure determines the percentage of income that must be paid in taxes. Call's income from acting, investments, and other sources is subject to income tax, and understanding the applicable tax rates and deductions is crucial in assessing his net worth.

- Property Tax: Property tax is imposed on real estate and is typically based on the property's assessed value. If Call owns real estate, property taxes will impact his net worth by reducing his disposable income and affecting his overall financial planning.

- Other Government Levies: Beyond income and property taxes, other government levies, such as sales tax, use tax, or capital gains tax, may also impact Call's net worth. Understanding the scope and implications of these levies is essential for analyzing his financial situation.

The tax burden faced by Brandon Call can significantly influence his financial decision-making and long-term wealth accumulation. Effective tax planning, including utilizing deductions, credits, and tax-advantaged investments, can help Call optimize his net worth and preserve his financial resources.

Expenses

Expenses, encompassing living costs, travel, entertainment, and other personal expenditures, play a crucial role in understanding Brandon Call's net worth and financial well-being. These expenses represent the consumption of resources and incurrence of liabilities that reduce his overall financial assets.

Living costs, including housing, utilities, groceries, and transportation, constitute a significant portion of Call's expenses and directly impact his disposable income. Travel expenses related to his acting career or personal pursuits, as well as entertainment and leisure activities, further contribute to his outflows.

Managing expenses effectively is essential for Call to maintain a healthy financial position. Prudent budgeting, mindful spending, and distinguishing between needs and wants can help him optimize his net worth and achieve long-term financial goals.

Understanding the dynamics between expenses and Brandon Call's net worth provides insights into his lifestyle choices, financial priorities, and overall fiscal responsibility. By carefully managing his expenses, he can preserve his wealth, plan for the future, and maintain a comfortable standard of living.

Lifestyle

The lifestyle choices an individual makes significantly impact their spending habits and, consequently, their net worth. In the case of Brandon Call, his lifestyle choices have played a crucial role in shaping his net worth over time.

Actors' lifestyles often involve significant expenses related to maintaining their public image, attending industry events, and pursuing personal interests. Call's spending habits may include investments in wardrobe, grooming, and travel, which can influence his overall financial situation.

Understanding the connection between lifestyle and net worth is essential for individuals in all walks of life, not just celebrities. Financial decisions should be aligned with long-term goals and values. By carefully considering the impact of lifestyle choices on spending habits, individuals can make informed decisions that support their financial well-being.

Financial Management

Financial management encompasses a range of strategies that individuals employ to manage their wealth effectively. These strategies play a crucial role in determining an individual's financial well-being and net worth, and Brandon Call is no exception.

- Investment Strategies

Investment strategies involve the allocation of financial resources across various asset classes, such as stocks, bonds, and real estate, to generate returns and grow wealth. Call's investment decisions, including the diversification of his portfolio and risk tolerance, directly impact his net worth. - Tax Planning

Tax planning involves utilizing legal strategies to minimize tax liability and maximize wealth accumulation. Call's ability to navigate tax laws, deductions, and credits can significantly influence his net worth over time. - Estate Planning

Estate planning involves the management and distribution of assets after an individual's passing. Call's estate plan, including trusts, wills, and powers of attorney, ensures the preservation and distribution of his wealth according to his wishes. - Retirement Planning

Retirement planning involves saving and investing for financial security during retirement years. Call's retirement plan, including contributions to tax-advantaged accounts and investment strategies, influences his long-term financial well-being.

Effective financial management, encompassing these strategies, is essential for Brandon Call to preserve and grow his net worth. By making informed decisions, seeking professional advice, and adapting to changing financial landscapes, Call can navigate the complexities of wealth management and secure his financial future.

Brandon Call Net Worth FAQs

This section addresses frequently asked questions regarding Brandon Call's net worth and provides concise and informative answers.

Question 1: How much is Brandon Call's net worth?

Answer: As of 2023, Brandon Call's net worth is estimated to be around $2 million. This figure represents the cumulative value of his assets, including earnings from acting, investments, and other sources, minus any outstanding debts or liabilities.

Question 2: How did Brandon Call accumulate his wealth?

Answer: Brandon Call's net worth primarily stems from his successful acting career. He gained prominence in the 1980s and 1990s for his roles in television shows such as "The Hogan Family" and "Step by Step." Additionally, Call has made investments and pursued other ventures that have contributed to his overall wealth.

Question 3: What is Brandon Call's annual income?

Answer: Brandon Call's annual income fluctuates depending on his acting projects and other sources of revenue. However, it is estimated that he earns a significant portion of his income from residuals and royalties from his past acting work.

Question 4: How does Brandon Call manage his wealth?

Answer: Brandon Call likely employs a team of financial advisors and wealth managers to assist with managing his net worth. This team may handle investments, tax planning, and other financial strategies to preserve and grow his wealth over time.

Question 5: What are Brandon Call's financial goals?

Answer: Brandon Call's specific financial goals are not publicly disclosed. However, it is reasonable to assume that he aims to maintain his financial stability, continue earning income through acting and other ventures, and secure his financial future.

Question 6: How can I increase my net worth?

Answer: Increasing your net worth requires a combination of factors, including developing income streams, managing expenses wisely, and making informed investment decisions. Seeking professional financial advice can also be beneficial in creating a personalized plan to achieve your financial goals.

Summary: Brandon Call's net worth is a reflection of his successful acting career and prudent financial management. By understanding the various components of his wealth, we gain insights into the strategies and efforts that have contributed to his financial success.

Transition to the next article section: Exploring Brandon Call's financial management strategies and investment portfolio can provide further insights into his financial acumen and long-term wealth preservation goals.

Tips Regarding "brandon call net worth"

Understanding the concept of "brandon call net worth" and its components can provide valuable insights for individuals seeking to manage their finances effectively. Here are some key tips to consider:

Tip 1: Track Your Income and Expenses

Maintaining a record of your income and expenses is crucial for understanding your financial situation and identifying areas for improvement. By tracking your cash flow, you can identify unnecessary expenses and make informed decisions about allocating your resources.

Tip 2: Create a Budget

A budget serves as a roadmap for your financial goals. By creating a budget, you can allocate your income to various categories, ensuring that your expenses align with your priorities and long-term objectives.

Tip 3: Invest Wisely

Investing is a powerful tool for growing your wealth over time. Research different investment options, such as stocks, bonds, and mutual funds, to create a diversified portfolio that aligns with your risk tolerance and financial goals.

Tip 4: Reduce Unnecessary Expenses

Take a critical look at your expenses and identify areas where you can cut back. This could involve reducing subscriptions, negotiating lower bills, or finding more affordable alternatives to your current spending habits.

Tip 5: Increase Your Income

If possible, explore ways to increase your income through additional work, starting a side hustle, or investing in education to enhance your skills and qualifications.

Summary:By following these tips, you can gain a better understanding of your financial situation and make informed decisions to manage your wealth effectively. Remember to regularly review and adjust your strategies as your financial circumstances and goals evolve.

Transition to the article's conclusion:Understanding "brandon call net worth" provides a framework for individuals to assess their own financial well-being and take steps toward achieving their financial goals.

Conclusion

The exploration of "brandon call net worth" has provided valuable insights into the multifaceted nature of wealth management and the strategies employed by successful individuals. Understanding the components of net worth, including income, investments, assets, and liabilities, is crucial for assessing financial well-being and making informed financial decisions.

Furthermore, the tips outlined in this article serve as a practical guide for individuals seeking to improve their financial management skills. By tracking income and expenses, creating a budget, investing wisely, reducing unnecessary expenses, and increasing income, individuals can take proactive steps towards achieving their financial goals.

In conclusion, understanding "brandon call net worth" extends beyond the mere accumulation of wealth. It encompasses a comprehensive approach to financial management that involves careful planning, informed decision-making, and a commitment to long-term financial well-being.